How to Avoid Being Shocked By Your Tax Bill This Year

August 12, 2022

When it comes time for tax season, many clients are unprepared for the bill when it arrives. Learning that more must be paid can leave many individuals scared, uncertain, and desperate for help. Fortunately, there are ways to minimize the shock that can come when filing, and a wealth advisor is here to better explain what you can do when it comes to tax planning in Dallas.

(more…)Tips to Raising a Financially Responsible Child

July 30, 2022

Raising children is a joy, and as a parent, you’re likely to find yourself being more mindful of your actions as they grow older. Wanting to instill good habits early on, you may be thinking about what you can do to not only teach them the value of a dollar but also how to be smart with their money. To help you on this pathway, here are a few ways to raise a financially responsible child.

(more…)Cadent Newsletter: Our views on Ukraine, Inflation and Interest Rates

April 25, 2022

3 Financial Conversations You Should Have With Your Spouse

February 9, 2022

One of the most pivotal aspects of a romantic relationship may also be the least romantic in nature – money. However, having a clear understanding of your and your spouse’s financial situation is core to building a strong and trustworthy relationship. Maybe you’re contemplating a special anniversary gift for your spouse but its steep price tag will put you in a financial bind. Maybe you want to use income from your side business to pay down debt but your spouse wants to save it toward other goals. All of us, if we’re honest, know there should be some balance in the way we approach these and the many other decisions we make every single day with another person in the picture, but how do we work together with a spouse who may see things differently than we do? Here are three financial conversations you should have to ensure honesty and openness around the subject of money in your relationship.

(more…)4 Ways to Increase Your Charitable Giving Impact

December 14, 2021

If you enjoy giving to others and watching them prosper through generosity, it may be time to consider meeting with a financial planner to discuss your long-term goals. Looking ahead to the future and the lasting impact you can make through your charitable giving should be part of your wealth management plan. So, what kind of strategy can you develop to benefit you now and in the years ahead? Here are four ways you can responsibly increase your giving impact while shaping your legacy.

(more…)3 Benefits to Consider When Choosing to See a CFP® Professional

November 22, 2021

You know you want to make a plan for your financial future. Between your assets, charitable giving, estate, and other needs in your life, you want to entrust someone with the right credentials to help you prepare for the years and life events to come. Instead of settling on just any financial planner, make sure you’re doing your research to find a CFP® professional you can trust. Here are three key benefits of choosing someone with the right certification to help you with your plan.

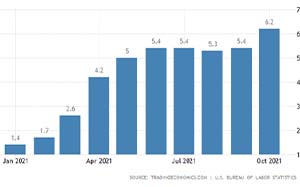

(more…)“Transitory” Inflation is Proving Stubbornly Persistent

November 15, 2021

The Federal Reserve (Fed) and Biden Administration cautioned earlier this year that rising inflation was to be expected and that it was transitory in nature. While they did not choose to provide guidance for what constitutes a transitory period, it is, by definition, not to be thought of as permanent. As the months and quarters tick by, it is clear the inflation we are experiencing extends beyond a purely transitory rebasing of prices and disrupted supply chain phenomenon.

(more…)Looking for a Financial Advisor? Here are 5 Questions You Should Ask

September 23, 2021

If you’re considering entrusting your finances to a professional, you’ll want to make sure you do your research. There are plenty of individuals who will vie for your business, promising to work in your best interest, but it’s important that you take the time to weed out the good from the bad. When planning a meeting with a promising advisor, you may feel uneasy about what to ask. Before your appointment, spend some time thinking about what it is you want from a financial advisor, and consider asking to ask these 5 questions to help you determine if who you’re hiring is right for you.

(more…)Inflation: Headline‐worthy or Just a Headache?

August 12, 2021

Last quarter, we took a look at inflation and taxes as rising concerns, and why they may not derail the stock market recovery. Since then, tax hike fears have moderated a bit, but that is a topic still very much in flux. Conversely, inflation concerns have accelerated as we’ve seen year‐over‐year inflation hit 5.4% as measured by the Consumer Price Index (CPI‐U). While admittedly alarming, upon deeper inspection, it is more like a small dog, more bark than bite, so far.

(more…)The “IT” Factor

May 4, 2021

A little over a year ago, just before COVID-19 was coming into focus, the economy and stock market seemed to have the “IT” factor. The global economy was improving, trending toward synchronous growth. Unemployment rates, inflation levels, interest rates and taxes were historically low – at least by modern standards. By most measures, the early 2020 economy and stock market could do no wrong. They had a certain je ne sais quoi that was hard to put a finger on, but it was undeniably working…you could say it had the IT factor.

(more…)