Inflation: Headline‐worthy or Just a Headache?

August 12, 2021

Last quarter, we took a look at inflation and taxes as rising concerns, and why they may not derail the stock market recovery. Since then, tax hike fears have moderated a bit, but that is a topic still very much in flux. Conversely, inflation concerns have accelerated as we’ve seen year‐over‐year inflation hit 5.4% as measured by the Consumer Price Index (CPI‐U). While admittedly alarming, upon deeper inspection, it is more like a small dog, more bark than bite, so far.

First, I do think it is important to recognize that inflation is more problematic for some than others. Those most negatively impacted cut across all age demographics from workers whose income is very slow to adjust with inflation, to business owners whose costs simply increase more than revenue, and retirees that are living off of modest fixed income. The challenges these groups face can be even more amplified than the broad inflation impacts we are seeing, if their spending or business supplies are in highly impacted segments. Fortunately, for most reading this article, your resources and circumstances allow for much more flexibility in when and what you spend money on. You also are “investors”, which is a critical distinction that allows one to benefit from the positive side of inflation, asset growth, during a transitory period.

What is Transitory Inflation?

While consumer price inflation is now above the 2% target on a year‐over‐year basis (5.4% for the 12 months ending in June 2021), the Fed believes that the increase is due to transitory factors, one of which is called base effects – inflation was low during last year’s lockdowns (the CPI rose just 0.1% for the 12 months ending May 2020) and prices are rebounding as the economy returns to normal. Another transitory factor is restarting pressures, such as supply chain disruptions and materials shortages.

Restart pressures occur in every economic recovery, but are more intense now due to the speed of the economic recovery. Fiscal policy has been larger than was anticipated at the start of the year and vaccinations have arrived quicker. The surge in economic growth caught some producers flat‐footed. February’s severe weather delayed supplier deliveries, and the pandemic has had a continued impact on foreign trade, made worse by container shortages and higher shipping costs.

Raymond James’ Chief Economist, Scott Brown does not see the transitory inflation pressures to last very long stating recently: “Base effects will continue for a few months, fading by late summer. Supply chain bottlenecks and input shortages may not be resolved as quickly and could put upward pressure on inflation beyond this year, but they will clear up eventually.

Labor market frictions will be more intense than in a typical economic recovery. Matching millions of unemployed workers to available jobs will be challenging. Schools and daycare facilities will reopen in the fall, which should lead to an increase in labor force participation; however, many older workers opted for early retirement during the pandemic and may be reluctant to reenter the labor force.

Fiscal policy will remain supportive into 2021, but less so, becoming a drag on economic growth (offset partly by a recovery in private‐sector demand). The increase in household savings, built up during the pandemic, should support consumer spending growth in the near term, but will be depleted over time. Economic growth is expected to moderate into next year, helping to reduce inflation pressures.”

What can we infer from the markets about inflation?

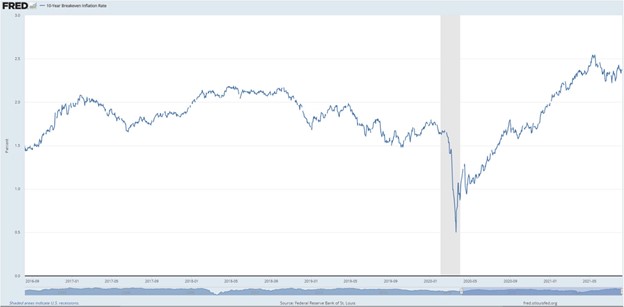

While Main Street is clearly worried about inflation persisting, Wall Street does not seem bothered. The stock market has continued to march forward, shaking off the recent inflation prints. More notably, the bond markets continue to have depressed yields, suggesting sentiment around interest rates is that they will remain low and relatively stable in the near‐term. The relative difference in yields between TIPS and nominal Treasury bonds is known as the breakeven inflation rate, or the implied inflation rate, and is an open market visible measure of what bond investors are collective willing to pay (or expect) for inflation.

For example, if a 10‐year TIPS yields 0.25% and a 10‐year nominal Treasury note yields 2.25%, then the breakeven inflation rate is 2.00%. If inflation is higher than 2.00% over the life of the bond, then TIPS should provide a higher total return than conventional Treasuries with the same maturity. Over the past 20 years, the 10‐year TIP breakeven inflation rate has averaged approximately 2%. Per the Federal Reserve Bank of St. Louis, as of July 31st, the 10‐yr Breakeven inflation rate is 2.4%.

What is next?

We remain cautiously optimistic that prices will stabilize. However, the next six months will be critical in seeing if recent inflation fears are, in fact, sensationalized. While we continue to monitor this, we continue to believe maintaining an appropriate equity allocation, or even tilting a bit toward equities is appropriate for those not facing loss of income or higher than typical spending, beyond the transitory effects of inflation, during this time. Of course, we welcome any questions you may have and are happy to more specifically discuss how we view inflation impacting you, your portfolio, and your financial plan.

About the Author

Casey Kupper, CFP®, CFA, CAIA® is one of a small group of professionals with both their CERTIFIED FINANCIAL PLANNER™ certification and Chartered Financial Analyst (CFA) marks. As a principle at Cadent Capital, he is dedicated to helping each client build a better future by making better decisions today. He understands wealth management is a journey, and each step is an opportunity to make an impactful decision on accumulating, investing, and sustaining your wealth. If you need help developing a plan that will guide your journey, call our office at (972) 441-4554 or visit our website.

Disclaimer: Any opinions expressed are those of the author and not necessarily those of RJFS or Raymond James. There is no assurance that any of the trends mentioned will continue or forecasts will occur. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk regardless of the strategy selected. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the US stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investors’ results will vary. Past performance does not guarantee future results. You should discuss any tax or legal matters with the appropriate professional.